texas travel nurse taxes

For true travelers as defined above the tax rules allow an exception to the tax home definition. What can cause your tax return to be audited.

Pros And Cons Of Accelerated Nursing Programs Nursing Programs Nursing School Nursing School Scholarships

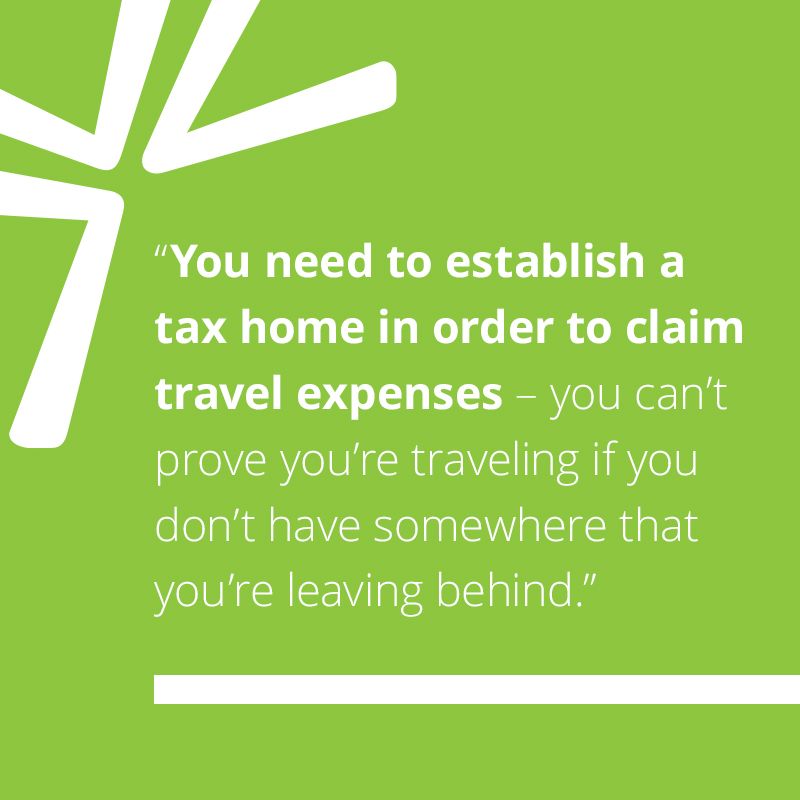

Travel Nurses Must Have a Tax Home To Qualify for Tax-Free Treatment by the IRS.

. Healthcare Facilities Click Here. First your home state will tax all income earned everywhere regardless of source. Tax-write offs are a unique ability of Travel Nurses and other Allied Pros but this benefit depends on your ability to prove that you have a tax home.

TNAA is proud to be a member of the National Association of Travel Healthcare Organizations NATHO. Companies can reimburse you for certain expenses while working away from your tax home. If you were working as a Staff Nurse you would typically be unable to write off housing travel or food expenses on your taxes.

Nursing boards and state tax agencies readily exchange information and some states treat tax delinquency as a basis for non-renewal of a license. The following nine tips can make filing your travel nurse taxes easier save you money and help you avoid future tax liability. Travel expenses from your tax home to your work.

From tax homes to keeping your receipts to knowing exactly how your income will affect your long-term financial goals here is the information you need to know about travel nurse taxes. You can also be part of the tax advantage plan in which some expenses are tax-deductible and some are non-taxable. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable.

Episode 2 Audit Triggers. Episode 1 Tax Deductions. Having a tax home will solve this problem.

Travel nurses are paid a blended rate of tax-free stipends and taxable hourly wage. Estimated taxes or quarterly taxes should be 25 of the tax you expect to owe for the year. This is the most common Tax Questions of Travel Nurses we receive all year.

These stipends and reimbursements are for expenses such as meals parking transportation fees and housing. Having no tax homes means they stay in hotels and hence more cost. Its not enough to simply abandon a residence but establish a new one.

RNs can earn up to 2300 per week as a travel nurse. Travel Nursing Tax Deduction 1. 1 A tax home is your main area not state of work.

Under the effects of the COVID-19 outbreak the healthcare world is facing unprecedented. There are two ways you can be paid as a travel nurse. This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you can think of these as travel expenses.

While higher earning potential in addition to tax advantages are a no. Travel Nurse non-taxable income. The fact that the income was not earned in the home state is irrelevant.

For a travel nurses stipends reimbursing travel and living expenses to qualify as tax-free under IRS rules the nurse must establish what is known as a tax home which is generally the city or area in which a taxpayers main place of work or business is located and where he or she earns the most. Texas Washington and Wyoming do not have income tax. While working as a travel nurse adds an additional layer of tax challenges it can also be a great way to gain a tax advantage.

Since travel nurses are working away from their tax home certain companies must legally provide stipends andor reimbursements for their work more on this below. Unfortunately you can only receive the tax-free stipend option if you can claim a permanent tax-home. If you are filing taxes as a travel nurse consider these suggestions to make tax season easier or ask a tax professional before you file for 2020.

Two basic principles are at work here. At Travel Nurse Across America we know that tax compliance and healthcare traveler documentation can be complicated. To make matters worse travel nurse taxes are probably the most challenging and disliked part about travel nursing.

This is how a lot of travel nurses handle taxes. Everyone has to have somewhere to live and something to eat but since that financial burden may be double for traveling workers the cost is alleviated through. At the same time the work state will.

Taxes and travel nursing can be very complicated so its best to consult an accountant. For nurses domiciled in a compact state the filing of a resident tax return is universally expected for renewal or validity. What is a deduction and what can you use for a deduction as a Travel Nurse.

These reimbursements or stipends can be tax free with proof of an official tax home in your home state and duplication of expenses. You will also need to pay estimated taxes since there are no tax withholdings for independent contractors. The expense of maintaining your tax home.

Also nurses are free to go anywhere in their breaks. Travel nurse taxes are due on April 15th just like other individual income tax returns. Well unfortunately travel nurses can see the country and escape the monotony of full-time employment but they cannot escape paying taxes.

Travel nurses are granted tax-free stipends and travel nurses save up to 10k annually compared to permanent nurses. The most prominent Travel Nurse Tax Deductions are Tax-Free Stipends for Housing Meals Incidentals Travel Reimbursements and Professional Development Costs. Here are some categories of travel nurse tax deductions to be aware of.

Each state return cannot be prepared in a vacuum as the results on one can be dependent on the other. Travel nurse earnings can have a tax advantage. Make sure you qualify for all non-taxed per diems.

Instead of looking at the primary place of incomebusiness it allows the tax home to default fall back on the permanent residence. Navigating taxes can be a bit different for travel nurses compared to traditional staff nurses. I could spend a long time on this but here is the 3-sentence definition.

The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home. 2020 TAX GUIDE FOR TRAVEL NURSES 2 2020 is a year like weve never seen before. Thats why we make staying compliant a top priority for our company and all of TNAAs travelers.

Tax-Free Stipends for Housing Meals Incidentals. Not just at tax time. Travel nurse income has a tax advantage.

For this to apply however the travel nurse must meet 2 out of 3 of the following criteria. Or are paid a fully taxable hourly wage taxed on the total rate of pay. Travel Nurse Tax Questions Videos.

Typically there are stipends or reimbursements for travel nurses.

Travel Nurse Aesthetics In Hawaii Travel Nursing Travel Travel Itinerary

Texas Travel Ct Technologist Texas Travel Travel Texas

Nursing Compact States Map And Chart Nursing Compact States Travel Nursing Travel Nurse Jobs

How To Make The Most Money As A Travel Nurse

The Requirements For Being A Travel Nurse Travel Nursing Nursing School Prerequisites Scholarships For College

5 Requirements To Becoming A Travel Nurse Travel Nursing Nurse Medical Jobs

All You Need To Know About Travel Nursing In The Us Infographic Travel Nursing Nursing Programs Nursing Tips

Infographic Travel Nursing Careers Choosing A Healthcare Staffing Agency Travel Nursing Travel Nursing Agencies Nursing Jobs

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Trusted Event Travel Nurse Taxes 101 Youtube

What Is Travel Nursing Academia Labs

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

Travel Nurses Share Your Stories Travel Nursing Nurse Nurse Humor

Top 10 Benefits Of Being A Traveling Nurse Rasmussen University

Updated Map Enhanced Nursing Licensure Compact Enlc April 2019 Nursing License Nursing Compact States Nurse

Infographic How To Get Your First Travel Job Nursing Jobs Travel Nursing Travel Nurse Jobs

Travel Nurse Taxes All You Need To Know Origin Travel Nurses